Investment Banking or Technology - Which is the better career path for MBA students? (Part 1: Compensation)

As usual, the answer to these types of questions is “it depends”. As someone who’s previously worked in investment banking, private equity, AND technology (Square, GitHub, Enjoy Technology), I feel uniquely qualified to opine on this subject. I’m going to break this down for you over a 4-part series. We will consider the following factors: compensation, exit opportunities, the work itself, impact, and lifestyle. Depending on what matters most to you, you can come to your own conclusions on which is the optimal career path for you.

In Part 1 this week, we’ll look at compensation.

This is probably one of the most important factors that candidates consider first. After all, you’ve probably invested well into the six figures just to get your MBA degree, so of course you want to see a great return on that investment.

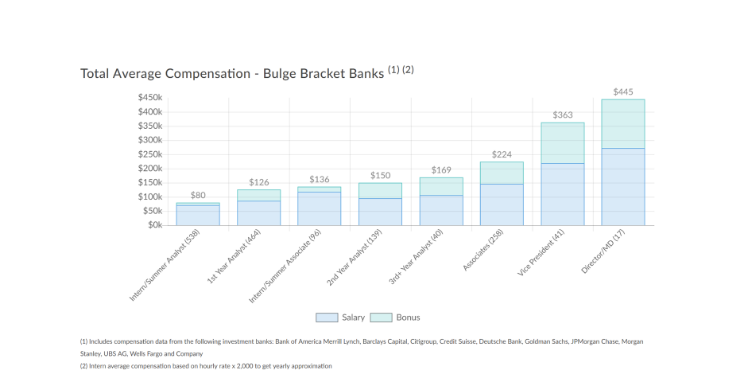

Based on 2018 compensation survey data from Wall Street Oasis, investment banking associates average $224k in total compensation. As you move up in seniority, it’s pretty realistic to be making $3-400k+ at the VP/Director level. As a Managing Director, you’re looking at $500k-$1m+, and it’s much more dependent on how much revenue you’re generating for the firm. But no matter how you slice and dice it, investment banking is still one of the highest paying jobs out there.

Now let’s look at the median starting salary for an MBA graduate from the elite M7 MBA programs who goes into technology in 2018:

Stanford GSB: $135k

Harvard Business School: $130k

UPenn Wharton: $130k

MIT Sloan: $130k

Columbia Business School: $130k

Northwestern Kellogg: $130k

Chicago Booth: $130k

So the cash compensation in tech is approximately a 40% haircut relative to investment banking. Ouch. But wait, that’s not the entire story. The big wildcard when working for tech is the stock options you get in the company. How much is that worth?

Well, this is tougher to quantify, as it really varies depending on the performance of the company you join. If you join the right company, your stock compensation could end up being worth six, or sometimes even seven figures. But according to CB Insights, 70% of tech startups fail, usually about 20 months after raising financing. So for the vast majority of people who join tech startups, their equity often ends up being worth nothing. Ouch again.

On the other hand, having the technology company you join reach a successful exit (typically an IPO or an acquisition by a larger company) can feel like winning the lottery. I know this because I’ve experienced it twice now: once when Square went public in 2015, and again when GitHub got acquired by Microsoft for $7.5 billion dollars in 2018. Having two seven-figure payouts in the span of three years should pretty much be considered the best case scenario. This is the type of outcome that has current MBA grads flocking to Silicon Valley.

So you’re probably wondering: how was I able to hit the lottery not once, but twice?

Well, certainly luck had something to do with it. But I’m a big believer that part of being lucky comes down to creating your own luck. Ironically, I attribute my luckiness in large part to starting my career in investment banking, and then subsequently private equity. The education I received on the job was what taught me to think like a professional investor in the first place. Advising some of the best companies in the world on a daily basis, seeing all types of different business models, and learning how to analyze the drivers behind a successful business all helped me eventually identify winners like Square and GitHub. The fact is, I had conviction that both of these companies had massive upside relative to their valuations when I joined. Square went from a $3 billion valuation to being worth $30 billion as of this writing, and GitHub went from a $750 million valuation to a $7.5 billion sale to Microsoft. Both ended up 10x’ing their valuations, proving my initial analysis correct. There is no way I could have known this would happen without all the training I received on Wall Street.

But there’s more. Being able to identify the winners is only part of the equation. The interest needs to be mutual. The best tech companies are some of the most popular companies to work for and are never short of qualified candidates. This means they only want to hire the best of the best. For example, when I joined the Finance & Strategy team at Square, our entire team was made up of former investment bankers and private equity investors. If you didn’t have the pedigree, you had no chance of getting in. Oh and by the way, your compensation is always anchored off of your previous compensation. My teammates and I all received significantly more stock options in the company because we were coming from Wall Street jobs with much higher cash compensation. That’s how you double down on the winners and ride the wave of success to a life-changing financial outcome.

The last thing I want to show you about compensation is a study that was done by Paul Oyer, a professor at Stanford GSB. In this study, he surveyed 2,598 Stanford GSB graduates between the class of 1960 to the class of 1997. He wanted to know two things: 1) what was their first job after graduating from Stanford GSB, and 2) how much money have they made over their entire career. He then discounted their earnings back to present value, or how much the money would be worth today. Here’s what he found:

Long story short, the Stanford GSB grads who started their career in investment banking made, on average, $1.5 to $5.5 million dollars more than their peers over a 10-20 year period. If you were looking for a more definitive way to settle the compensation debate, I think this is pretty much it.

Winner: Investment banking is the best risk-adjusted bet. For tech to win out, you’d have to identify the winners before they’ve become winners. Ironically, investment banking teaches you the skills to do exactly that.

Next week, we’ll be back with part 2 and talk about exit opportunities. Stay tuned!

About the Author:

Sam Shiah is the founder of Wall Street Mastermind. As a former investment banker (Morgan Stanley, Deutsche Bank) and private equity investor (GI Partners), he closed 14 deals worth $9 billion in transaction value during his career on Wall Street. He is an expert on the investment banking recruiting process and a sought-after coach for aspiring investment bankers. Securing his first role in banking in 2008 despite one of the worst job markets in Wall Street history, Sam has first-hand knowledge of just how competitive and challenging it is to break into the industry, which has a <1% acceptance rate. More importantly, having been a part of the on-campus recruiting team at Morgan Stanley, he has intimate knowledge of how the recruiting process works at top-tier banks and has both screened and interviewed hundreds of candidates from the other side of the table. After his career on Wall Street, Sam worked at several technology startups in Silicon Valley, including Square and GitHub, before founding Wall Street Mastermind.

SHARE THIS POST: